During the AFC of 1997 and the GFC of 2008 Malaysia was one of the countries that were affected. Specifically the findings suggest that without the countercyclical and discretionary interest rate cuts and exchange rate flexibility the global financial crisis would have been associated with a much deeper economic contraction in Malaysia.

Finance Development June 2008 Point Of View Asia A Perspective On The Subprime Crisis

In the first crisis Malaysias economy collapsed resulting in a.

. Malaysias economy has been battered since a budget projection was first made late last year with the country beset. What started as an asset. This crisis had lead to the collapse of Kuala Lumpur Stock Exchange KLSE whereby the KLSE composite index had faced the decrease of 448 in 1997 Azmani Habibullah Law Dayang 2006.

This chapter discusses the importance of trade to the economy and Malaysiafs reliance on demand generated by developed economies. During the run companies moved a record 172 billion out of their money market accounts into even safer Treasury bonds. Malaysia like most Southeast Asian.

Helped soften the impact of the global financial crisis of 200809. Besides during the economic crisis in 2008 the bank system has a sufficient capital to recovery from the crisis and Malaysian authorities had limited exposure to foreign bank borrowing. As a result of the global economic slump and a sharp decline in commodity prices in the second half of 2008 Malaysias GDP declined to zero.

The purpose of this research is to determine the impact of global financial crisis 2008 on banking industry in Malaysia. In 2009 Malaysia injected US16 billion into its economy as part of a stimulus package to combat slowing growth and rising unemployment. Anticipating the downturn that would follow the episode of extreme financial turbulence Bank Negara Malaysia BNM let the exchange rate depreciate as capital flowed out and preemptively cut the policy rate by 150 basis points.

ECONOMIC IMPACT AND RECOVERY PROSPECTS MOHAMED ARIFF SYARISA YANTI ABUBAKAR I. The quality of. Our analysis of the impact of the recent global financial crisis on Malaysia therefore begins with an understanding of the Asian financial crisis of 19979 and how it shaped this crisis.

Outstanding loans expanded at an annual rate of 101 between July 2007 and July 2009. Extremist groups such as ISIS Al Qaeda and Boko Haram thrive in unstable environments such as this. The deficit reached 67 per cent during the 2008-2009 global financial crisis.

Financial sector after the Asian financial crisis to be more resilient and hence were able to avoid a financial meltdown. The Malaysian Institute of Economy Research MIER said that the Malaysian economy may grow at its slowest pace since 2000 and may expand at 34 percent in 2009 after growing at 53 percent this year. The chapter analyzes the impact of the current crisis on the.

The economic crisis of 2008 had its origins in the United States and subsequently affected the economies of developed countries including the European Union Japan and Singapore. Predatory lending targeting low-income homebuyers excessive risk-taking by global financial institutions and the bursting of the United States housing bubble culminated in. This article argues that because of its size and openness Malaysia was severely affected by the.

The collapse of oil destabilized many developing nations dependent on stable oil prices. INTRODUCTION RIOR to the crisis Malaysia had been dubbed as one of the miracle economies in East Asia owing to its maintenance of high growth rates averaging 89 per cent during the period 198896 in addition to low inflation rate. Impact of the banking crisis on bank intermediation The financial intermediation process in the Malaysian financial system has remained orderly throughout the period of economic turbulence with continuing flows of credit to the real economy.

Unfortunately due to 1997 Asian Financial Crisis Malaysias economic had faced with a serious recession due to the depreciation value of Ringgit Malaysia. Malaysia was hit hard by the global financial crisis of 2008-09. In particular the palm oil rubber and oil and natural gas sectors were the hardest hit due to the impact of the global financial crisis.

The financial crisis of 2008 or Global Financial Crisis was a severe worldwide economic crisis that occurred in the early 21st century. This research used global financial crisis as the dependent variable and the independent variables are earnings per share EPS share price total asset ratio deposit lending ratio and capital adequacy. On September 17 2008 the crisis created a run on money market funds where companies parked excess cash to earn interest on it overnight and banks then used those funds to make short-term loans.

Malaysia has learned from the Asean financial crisis in 19971998 and much stronger position when entered the global financial crisis in 2008. THE MALAYSIAN FINANCIAL CRISIS. The Global Financial Crisis and the Malaysian Economy.

It is likely that growth would deteriorate in late 2008 as the Malaysian economy takes the hit from the knock-on effects of a flagging global. It was the most serious financial crisis since the Great Depression 1929. For Malaysia the country suffered the impact in terms of financial and trade channels.

How Did The Financial Crisis Of 2008 Affect Malaysia. The paper Asia in the World Economy - Impact of the 2008 Global Financial Crisis on Malaysia is a dramatic variant of the case study on macro StudentShare Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. This chapter argues that Malaysia being a small open economy with a strong export-dependent manufacturing sector was particularly vulnerable to the global financial crisis.

Libya Iraq Nigeria Sudan and Syria. The global financial crisis was triggered by the bursting of a speculative bubble in the US housing market in 2008 impacting Malaysia in terms of trade and investments. Banks were repackaging these debts and selling them to investors.

The 2008 financial crisis was transmitted to Malaysia mainly through the financial and trade channels. Share prices in Malaysia fell by 20 between 2007 and 2009 a massive exodus of short-term capital flows took place and exports fell by 45. Against this backdrop this paper tries to quantify how much deeper the.

These developments had a tremendous impact on the Malaysian economy. The global financial crisis of 2008-2009 with its epicentre in the United States has brought enormous ramifications for the world economy. Malaysia a trade-dependent country was severely hit in.

As with most of the East and Southeast Asian economies the impact of the global economic and financial crisis on Malaysia has been felt largely through a. The financial crisis effect in Malaysia in the 4 th quarter of 2008 due to Malaysia just a small open and export-dependent economy country. Extreme Volatility in Malaysian Ringgit has roots in the 2008 Financial Crisis.

Malaysias economy has recovered from 2009. The business community on the impact of the crisis reactions to the stimulus. The global financial crisis of 200809 that started in the US was caused by excessive lending by banks especially housing loans.

Chapter 1 Financial Crises Explanations Types And Implications In Financial Crises

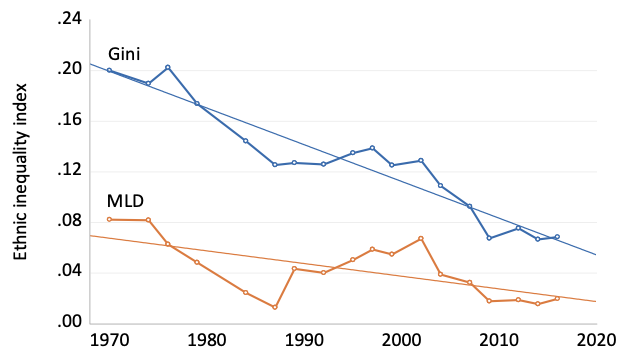

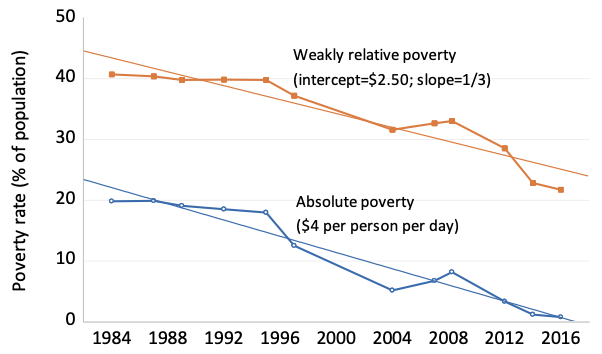

Ethnic Inequality And Poverty In Malaysia Since May 1969 Vox Cepr Policy Portal

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

Malaysia S Journey To Become The Next Asian Superpower World Finance

Explaining Malaysia S Deflation Since The 2009 Crisis Asean Today

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

Pdf Impact Of Global Financial Crisis On The Performance Of Islamic And Conventional Banks Empirical Evidence From Malaysia

Malaysia S Journey To Become The Next Asian Superpower World Finance

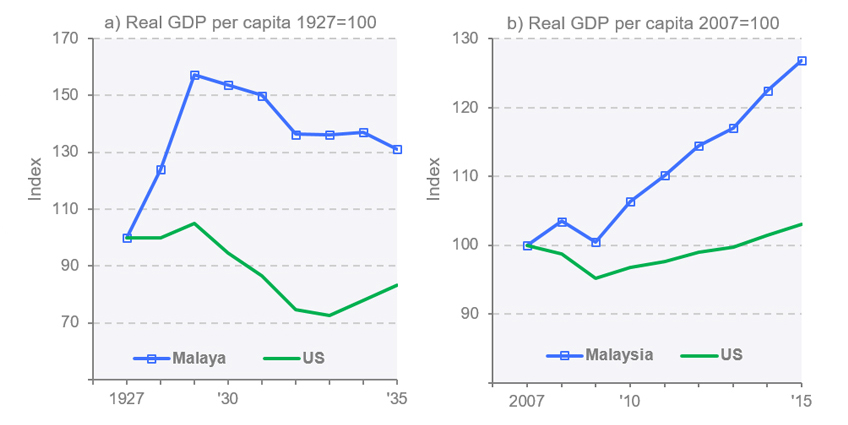

A Tale Of Two Crises Great Depression And The Great Recession Articles Economic History Malaya

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

Pin On Financial Globalisation And Globalisation And The Environment

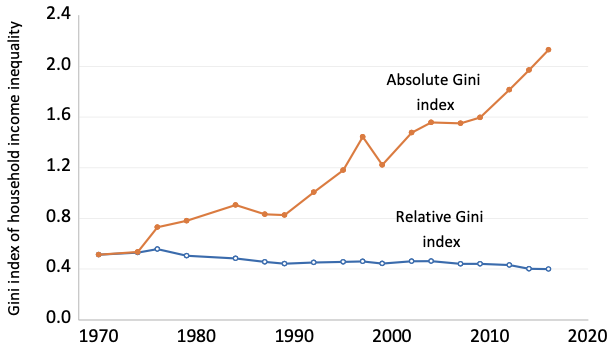

Ethnic Inequality And Poverty In Malaysia Since May 1969 Vox Cepr Policy Portal

Ethnic Inequality And Poverty In Malaysia Since May 1969 Vox Cepr Policy Portal

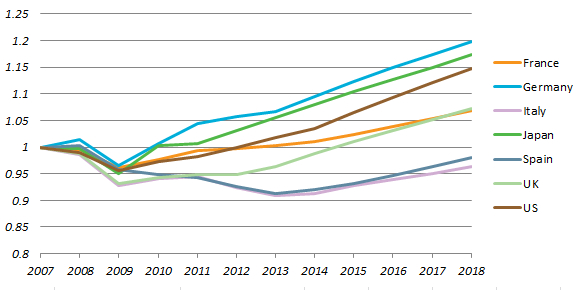

The Recovery From The Global Financial Crisis Of 2008 Missing In Action Euromonitor Com

Malaysia S Journey To Become The Next Asian Superpower World Finance

Asian Financial Crisis Of 1997